Medicare Advantage vs. Medicare Supplement (MediGap) Which Is Best?

The MediGap (Medicare Supplement) Option:

Original Medicare (i.e. Medicare Part A and Part B alone) is a “fee for service” health insurance plan. Therefore, Medicare beneficiaries are required to pay copayments and deductibles only if they utilize a “Medicare-covered” medical service. Following are examples of costs left behind after Original Medicare pays that the beneficiary is responsible for:

- Hospital Admission: $1,484 for each benefit period (1-60 days).

- Physician visits: copayment = 20% of the “Medicare-allowed” amount (i.e. average of $40 for a primary care visit and $70 for a specialist visit).

- Out-patient Surgery and DME Supplies: copayment = 20% of the “Medicare-allowed” amount.

- Nursing Home: Medicare will cover days 1-20 at no cost (if all Medicare coverage requirements are met), then beneficiary is required to pay $185.50 per day (days 21-100). There is no Medicare coverage after day 100.

A Medicare Supplemental (MediGap) policy is designed to pay for most all copayments left behind by Original Medicare. A MediGap policy, however, will only cover medical services that are first covered by Medicare. If Medicare does not cover the medical service, the MediGap supplement plan will also not cover it.

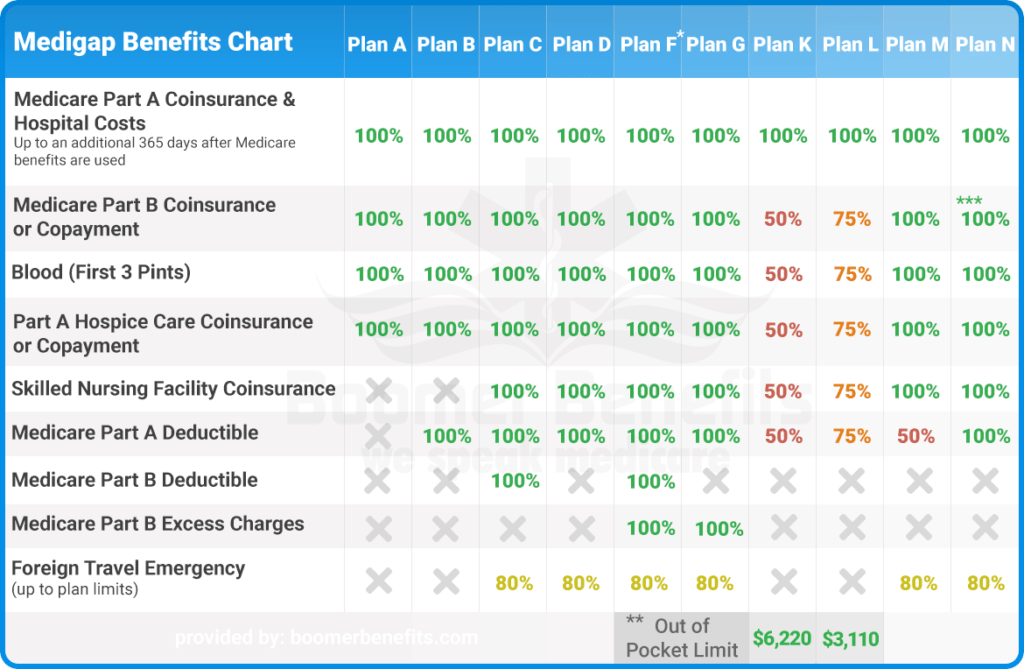

There a several different types of Medigap policies, which have varying levels of coverage. These options are summarized below:

Note: “Plan F” is no longer sold new Medicare beneficiaries.

As with any Medicare option, there are pros and cons you should consider before purchasing a MediGap policy.

Pros:

- Any doctor (nationwide) who accepts Medicare as payment will also accept a MediGap policy as secondary coverage. It makes no difference what company the MediGap policy is purchased from. Also, all MediGap policies that have the same plan name type (i.e. G,N,D, etc) must provide “identical” coverage by law. In order words, Plan G purchased from Company X must be the very same as Plan G purchased from Company Y.

- No referral is required to see any physician who accept Medicare.

- Most copayments left by Original Medicare are completely covered by a MediGap policy. Depending on the MediGap plan selected, the beneficiary may still be responsible for part of the bill.

Cons:

- MediGap policies typically cost $75 to $250 per month (depending on the type of plan purchase and the company the plan is purchased from.

- If a MediGap policy is purchased, a typical monthly bill will be:

Part B Premium: $148.50

Prescription Drug Plan: $18

MediGap Supplement: $120

Total monthly bill: $285.00 (price varies) or about $3,400 per year.

** if a Dental/Vision plan is purchased, it may cost an additional $40 to $100 per month

3. You must pay the monthly premiums every month- even if you do not use any Medical services.

4. A prescription drug plan must also be purchased (average cost = $13 to $40 per month).

5. Additional benefits such as dental, vision and transportation coverage are generally not provided by Medicare or by most MediGap policies.

6, As the beneficiary gets older, the premium cost for their MediGap policy will continue to rise.

The Medicare Advantage (MAPD) Option:

The Medicare Advantage (MAPD) option has become increasingly popular in recent years due to its low cost and the inclusion of additional ancillary benefits. Medicare Advantage plans combine Medicare Part A + Part B + Part D all into one package, which is referred to as Part C (i.e. also called Medicare Advantage or MAPD). MAPD plans are private companies who contract with Medicare to provide Medicare services to beneficiaries who choose to enroll in one of their plans. By law, MAPD plans must provide services that are at least equivalent to services offered by Original Medicare. Unlike Original Medicare, however, MAPD plans also provide additional benefits such as dental, vision, and free gym memberships. MAPD plans are offered by many different companies (such as Humana, Aetna, WellCare, United Health Care, and others), who compete against each other trying to entice beneficiaries to enroll with their company. Company A may be more competitive than Company C because they offer a better dental package, while Company A may be more enticing than Company C to some because Company A offers transportation services and Company C does not. Before choosing to enroll in an MAPD plan, there are many factors you should consider.

A few of these factors include:

- Are your doctors in network with the plan?

- Are all medications you take covered by the plan?

- Does the plan offer out of network coverage?

There are many more important factors to consider but are too numerous to be adequately covered in this article. See the article “Factors to Consider before Enrolling is a Medicare Advantage Plan” for a more in-depth discussion on this topic.

Pros and Cons to consider prior to enrolling in a Medicare Advantage plan include:

Pros:

- Medicare Advantage (MAPD) plans (referred to as Medicare Part C) have low monthly premium costs ($0.00 monthly premium in many cases).

- MAPD combines the benefits of Part A, Part B and Part D to provide all Medicare and Prescription drug benefits into one plan. No need to purchase a separate prescription drug, dental or vision plan.

- Copayments are predictable and cannot exceed a stated yearly amount.

- No out-of-pocket costs unless a Medicare-covered service is utilized by the beneficiary.

- Additional benefits, including dental and vision coverage, ability to order OTC items at no additional cost, free gym memberships are often provided.

- Some MAPD plans provide a “Part B Buy-Down” benefit of $30 to $70 to help pay our Part B monthly premium.

- Coverage provided by MAPD plans must be equal or better than Original Medicare.

Cons:

- Provider networks are limited. Not all physicians accept every MAPD plan. it is important to verify that your physicians, hospitals and other health care providers are in the plan’s network before enrolling.

- HMO plans do not provide “out-of-network” coverage (unless in emergency situations). PPO plans, and some HMO-POS and PFFS plans do provide out-of-network coverage (but it is important to check ahead of time before enrolling).

- Typical “out-or-pocket” copayments with MAPD plans are:

- Hospitalization: $300 per day for days 1-6

- Physician visits: Primary Care MD: $0-$10; Specialist MD visit: $20 -$50

- ER visit: $90

- Out-patient Surgery: $250-$350

- Ambulance: $250-$280

Keep in mind, it is possible to cover these copayments with a Hospital Indemnity policy for a relatively low monthly cost premium cost.

It is always best to discuss your options with a knowledgeable insurance agent before deciding which way to go. If a wrong decision is made, you may not be able to correct it until the next year, and in some cases, the “bad decision” may not be reversible.

SHARE WITH

Contact Us

Related Posts